Moni's Edge #2: We're back from being so back

Alpha, Early Projects, Market overview, random thoughts, and just magic – wagmi.

gm, degens!

First of all, thanks to everyone for so much positive vibes, feedback and support. You’re just the best. Love y’all.

What's inside today?

Weekly dose of:

- Market is down bad again;

- Bots, Mantle narratives;

- 5 early alpha projects;

- Potential Catalysts and events;

- Useful threads, articles, tools and random thoughts;

💜 If you love us and would like to support us, click the button below:

State of the Market and News

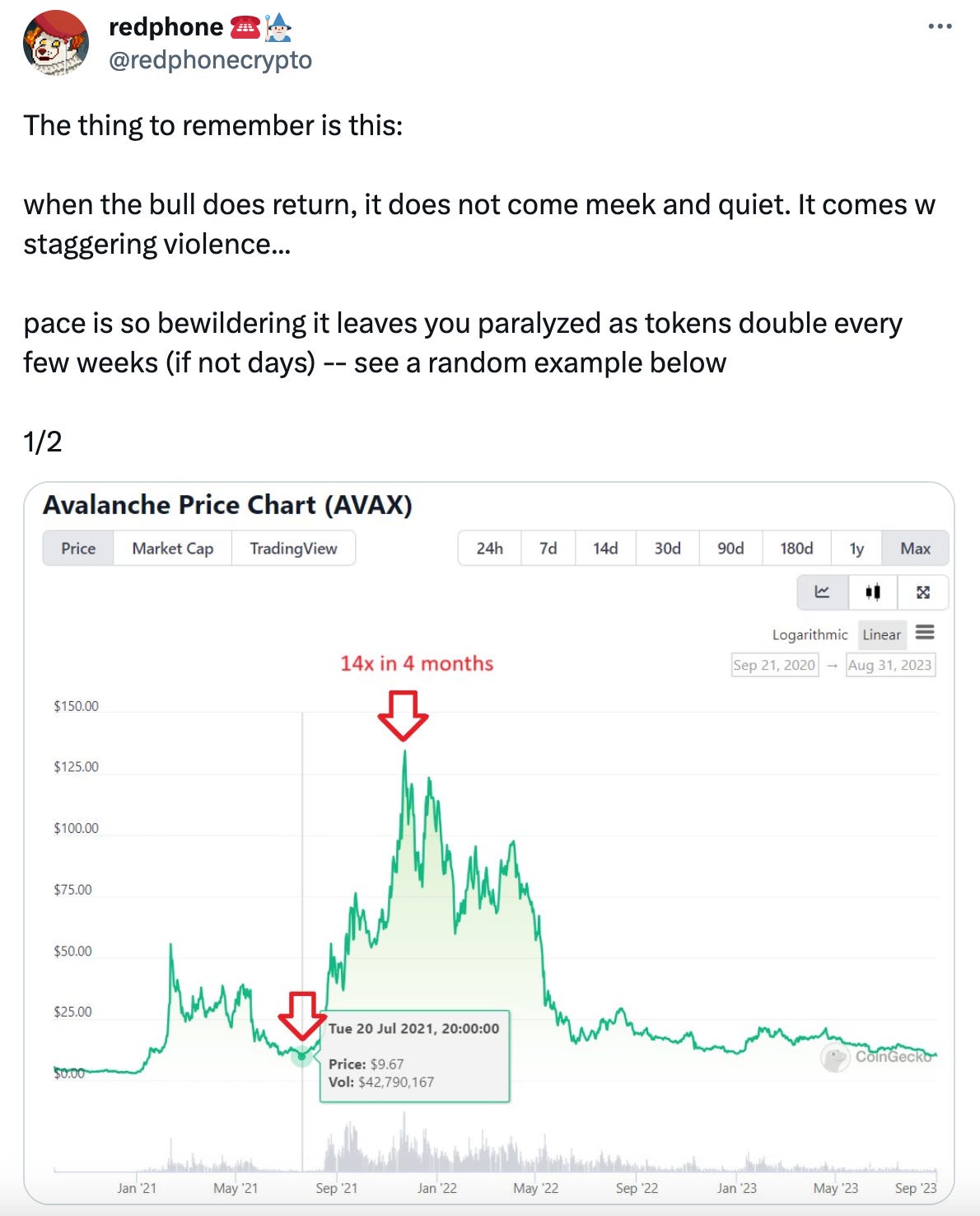

Okay, we run back TURBO the Grayscale Victory over SEC, fully retraced to $26 000…

The SEC has been postponing all ETF decisions, and we anticipate further delays for all of them. We're expecting a turbulent market for September with potential downturns, especially during times when ETF approvals are in the spotlight.

Currently, Bitcoin sits at $26k, aligned with its prior support level. The RSI isn't as deeply oversold as it was just a week ago, indicating that we might see a sideways movement with a potential dips.

Also, August, let’s break it down. It is usually not Bitcoin's best friend, but September is fucking Bully, sooo act accordingly. But, the last quarter of the year tends to be pretty solid for Bitcoin.

Also check this on Markets:

Some moves and thoughts from the Moni team:

Any dips are essentially buying opportunities if you're in it for the Long Term. Just do not deploy all your capital at once. We've been DCA-ing (Dollar-Cost Averaging) Bitcoin, Ethereum, and a few other coins for a while now and will continue do so. But as degens we also are playing with narrative tokens and rotations.

As Degens for potential catalyst-driven plays we're eyeing:

DYDX: With version 4 on the horizon, they'll introduce their own chain and plan to distribute revenue to stakers. Stakers can anticipate roughly a 20% APY.

Optimism: We're thinking of buying OP tokens and considering beta positions with Velodrome and Aerodrome.

Unibot: We aim to buy on price dips, given its dominant position in the bot narrative.

WINR: It's an exciting beta play within the GambleFi narrative. They're rolling out new features like AA, new games, degen level leverage, and UX/UI improvements. Plus, they're constructing their own chain to offer white-label onboarding solutions for other gambling platforms to transition on-chain.

🧠 Stay strong, stay solvent, and you'll be rocking the coming Bull Market. It’s really important to show up, level up your skills, and educate yourself while we have time for that.

Narratives for Rotatoooors

Bots

While the hype around Bots may have peaked for now, it remains incredibly beneficial, especially for degens. So, this field isn't going anywhere.

With that said, we're continuously monitoring new automation-related projects, and we've noticed an uptick in their emergence lately. What's particularly intriguing is that a bot can now juggle two narratives simultaneously. Take, for example, a bot designed for Friendtech — it's far from redundant.

On this dashboard, not all bots are featured, but it's notable that none come close to rivaling Unibot. Any ideas why that might be?

By the way, we believe that one of the projects that could truly compete with Unibot is the Banana Gun Bot. We'll dive into that shortly.

Mantle

We've been tracking this chain for some time. Sadly, since its inception, it hasn't garnered much attention from users or degens yet. Just take a look at its TVL or the current state of the memecoin market — it's pretty stagnant.

BUT it can change

You might've heard that Mantle boasts one of the largest treasuries among all projects. Word on the street is they're gearing up to inject that capital back into their network, encouraging the birth of new initiatives.

Such a move could give the network a significant boost, luring degens from less hyping chains like Shibarium and opBNB over to Mantle.

It's worth pointing out that even now, Mantle has some promising projects brewing. Take BetBitX, for example — a GambleFi protocol gearing up for its IDO. Should it take off, it might inspire more teams to launch gambling ventures on Mantle.

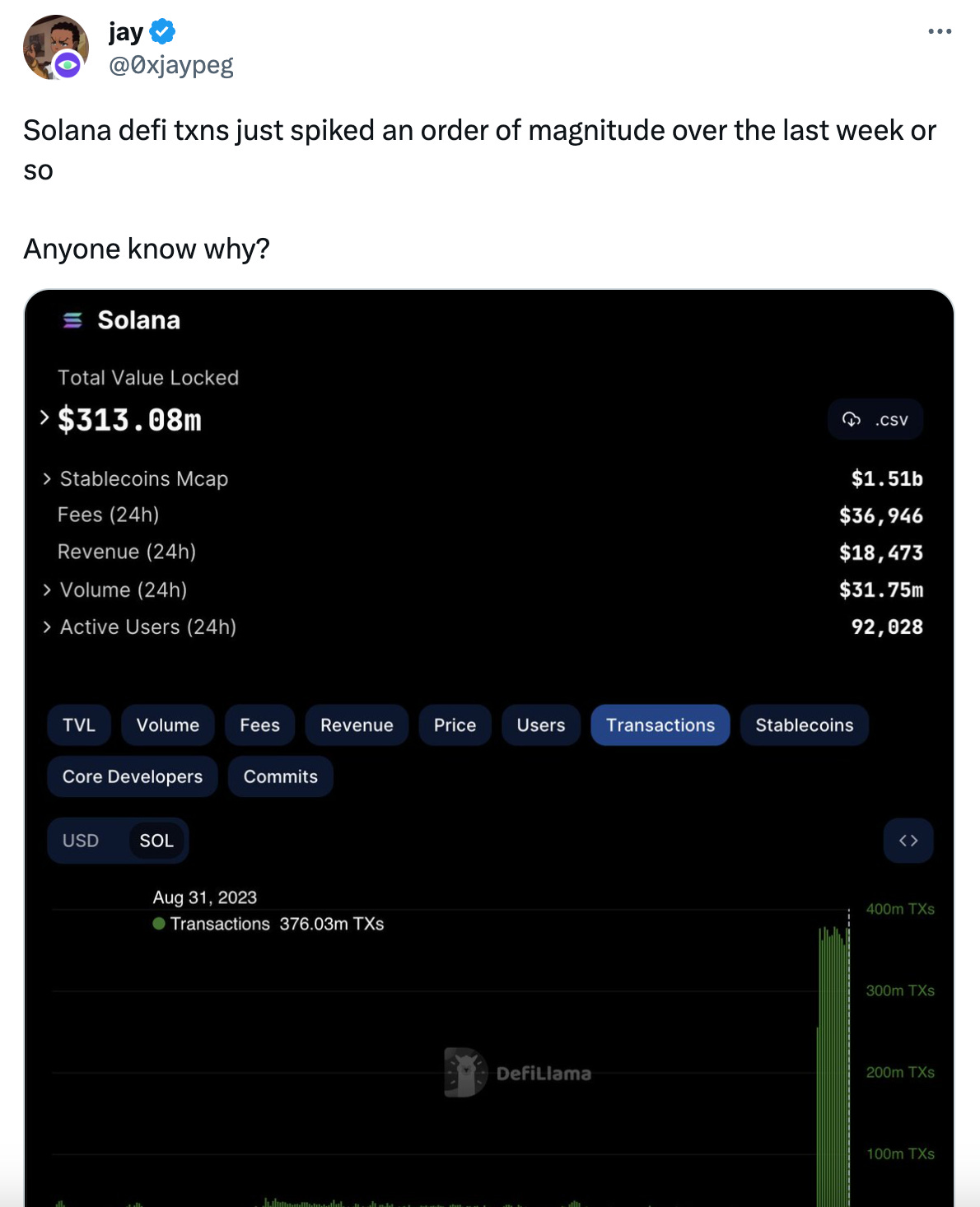

? Solana sneakily forming a Narrative inside the ecosystem?

dunno, dunno… check the previous Moni’s Edge#1

Moni's Edge #1

gm, degens! We’re experimenting, as always. Here’s our first take on the Moni substack alpha newsletter. What's in it for you? Weekly doses of: - Our unfiltered thoughts on the state of the market. - A spotlight on the hot narratives. - Early alpha projects.

Early projects (mostly Degen plays)

BaboonTools

The primary function of this new bot is to copytrade smart degens. There was a similar attempt at this about a month back, but it didn't really catch on. It'll be interesting to see how this one fares.Chain: Ethereum

Narrative: Bots

Twitter: https://twitter.com/baboontools

The project first popped up on the Moni Discover off-chain analytics app on August 29th. It's shown a touch of intelligence and a gradual increase in organic followers.OmniX

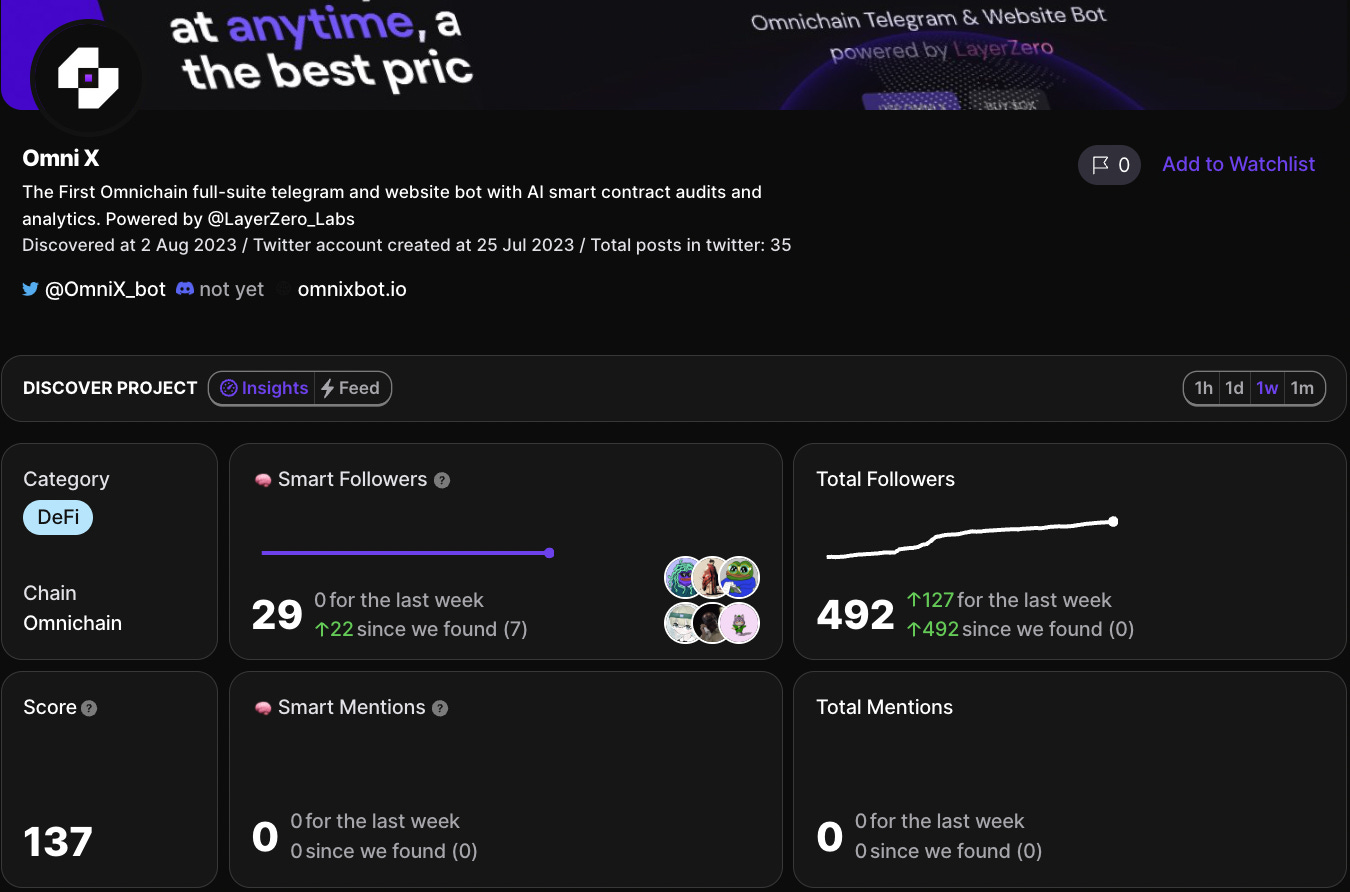

There's a fascinating bot over on LayerZero. And no, it's not just another bot for sybils. This one lets you utilize funds across multiple chains, allowing you to tap into protocols from Ethereum and other chains all within a single bot. The project plans to roll out a token similar to Unibot's. When using the bot, a fee will be applied, and this will then be distributed among $OM holders.Chain: LayerZero

Narrative: Bots

Twitter: https://twitter.com/OmniX_bot

The project made its debut on the Moni Discover off-chain analytics app on August 2nd. Given that they've been active on Twitter for around a month, they've attracted a significant number of smart followers and founders from private communities.DraftShares

It's another fork of Friendtech, but with a twist for soccer fans. They plan to release the initial 32 shares representing the starting 32 NFL quarterbacks. Users can trade these shares, so the concept isn't groundbreaking. But given that it's rooted in the Friendtech model and remains a trending narrative, it's a project that deserves attention.Chain: Base

Narrative: FriendTech

Twitter: https://twitter.com/Draftshares

The project first appeared on the Moni Discover off-chain analytics app on August 31st. Mostly followed alpha-hunters and two major Influencers, one of which is LilMoonLambo - who fits the project's target audience perfectly.

WandBot

OzDAO has rolling out a new trading bot. This is bound to reel in the degens and smart apes, given that OzDAO is a private community packed with the real heavyweights in this domain. I'm keen to see the tools they'll introduce and whether access will be extended to those not holding the primary NFT collection.Chain: -

Narrative: Bots

Twitter: https://twitter.com/wand_bot

The project made its debut on the Moni Discover off-chain analytics app on August 31st. Beyond the OzDAO community members, it seems to be drawing a lot of attention from alpha hunters intrigued by the product. Given that the account was set up just a few days ago and it's quickly gaining traction, I wouldn't be surprised if its followers multiply in the next few days.

Banana Gun

This sniper bot has been around for quite some time, nearly as long as Unibot.What sets it apart is that it hasn't rolled out its own token yet, which might explain why it's not as buzzed about as other bots.

has tested out Banana Gun's features a few times and finds it incredibly user-friendly.We're on the lookout for when they launch their token. To give a clearer perspective on why we see potential in this project, let's draw a comparison between Unibot and Banana Gun.

Avg. users for the last 7 days

Unibot - 2217

Banana Gun Bot - 2363

Avg. trade volume for the last 7 days

Unibot - 7,49M$

Banana Gun Bot - 6,58M$

Fees/Revenue (24h)

Unibot - 41k$

Banana Gun Bot - 34k$While Banana Bot has a slight edge over Unibot in average user numbers, it generally trails in other areas. We believe the presence of a token is pivotal, aiding Unibot in attracting new users and retaining existing ones.

Reflecting back on the height of the bot narrative, many highlighted Unibot as the primary bot, emphasizing its token. So, there's a good chance Banana Gun Bot could gain more traction once its token rolls out, positioning itself as a formidable contender in this space.

Catalysts, News & Updates

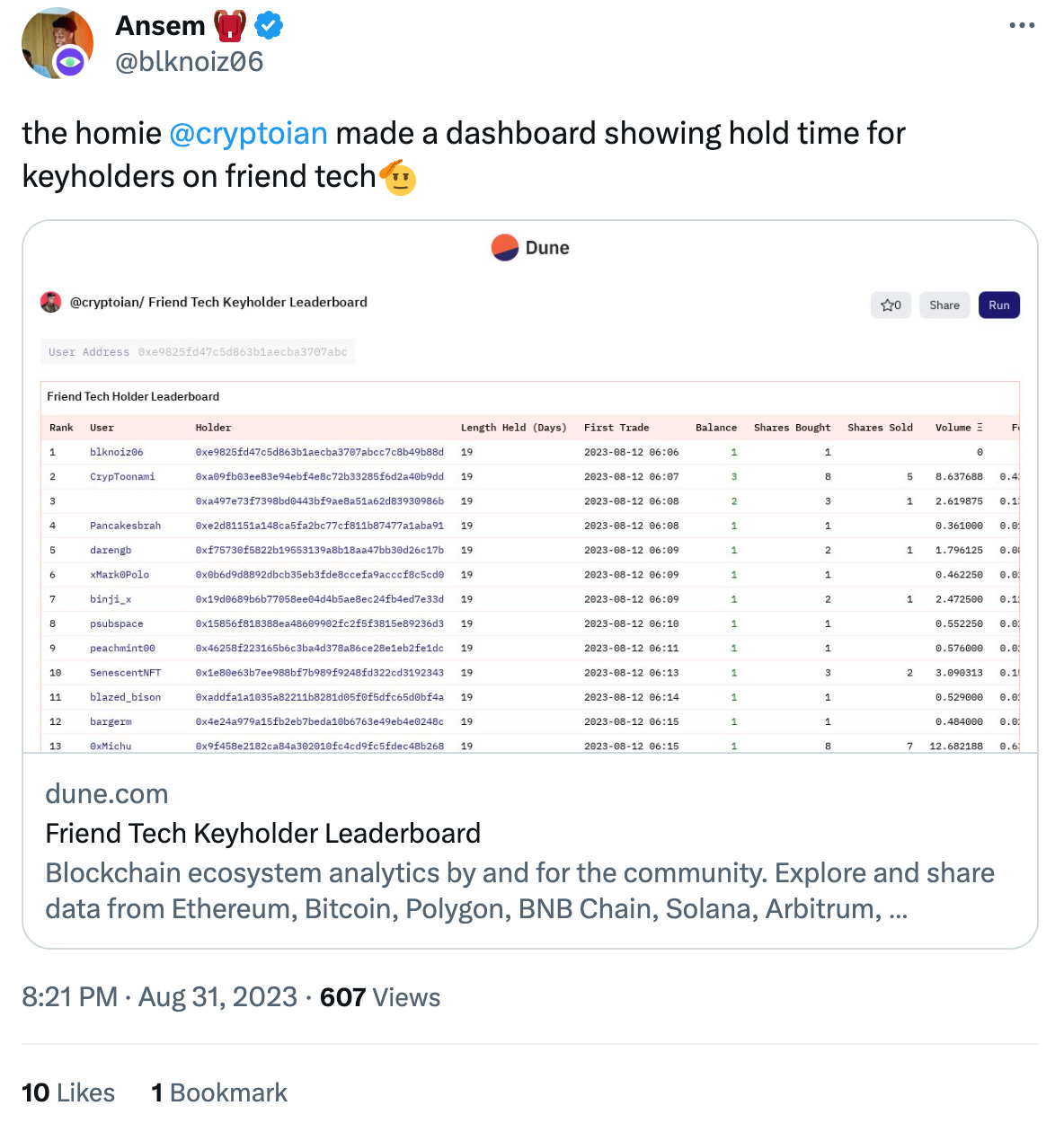

Cryptonian Dune Dashboard showing hold time for keyholders on friend tech

Base and Optimism are frens.

Base has agreed to allocate the larger amount between 2.5% of the total sequencer revenue and 15% of its net on-chain sequencer revenue to the OP team. In exchange, they'll secure a grant of 118M $OP, equivalent to $174.6M, which will vest over a 6-year period.

Other Dope Stuff you should check:

Account abstaction as the way to attract adoption to crypto by Informis

Weekly Narrative Update by Beacon

Good breakdown of the fundamental design differences between Layer Zero and CCIP

10 ideas Brian Armstrong wants to see in crypto

🫡 Thanks for reading, fren!

That’s it, end of the 2st issue. Please consider leaving feedback in the comments and vote in this poll.

Give us a follow on Twitter at @getmoni_io and join our Discord Community.