Moni's Edge #1

Alpha, Early Projects, Market overview, random thoughts, and just magic – wagmi.

gm, degens!

We’re experimenting, as always. Here’s our first take on the Moni substack alpha newsletter.

What's in it for you?

Weekly doses of:

- Our unfiltered thoughts on the state of the market.

- A spotlight on the hot narratives.

- Early alpha projects.

- Projects updates

- Potential Catalysts and events

- Useful threads, articles, tools and random thoughts

In a nutshell? Pure, undiluted alpha, served hot and fresh. For degens, by degens. 🌪️

💜 If you love us and would like to support us, click the button below:

State of the Market and News

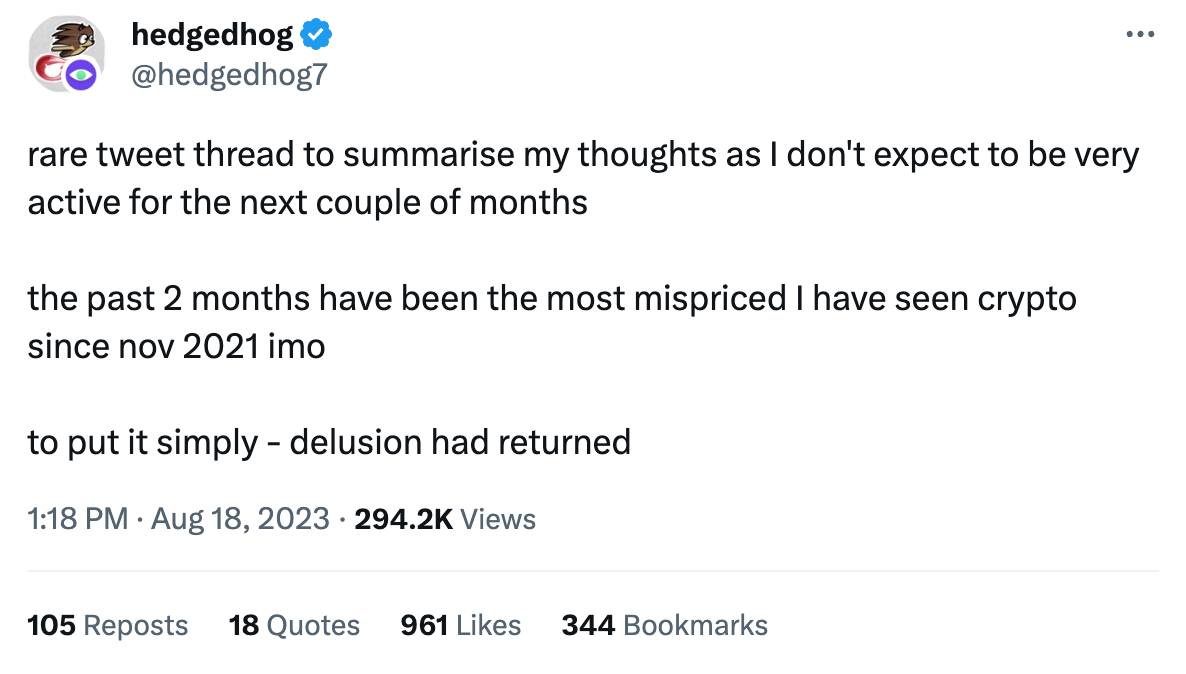

After a long chop market and almost zero volatility on BTC, it seems we got bored and decided to dump to $25 000, liquidating more than a billion dollars along the way.

Following the liquidation event worth $1 billion, open interest has returned to its usual levels. However, the market's price movement has been muted due to the aftermath of the short liquidation cascade.

The RSI of Bitcoin has dropped below 20 (which indicates that Bitcoin is oversold), and we have fallen below the MA200 (which is bad, but not as bad as drawing a new Lower Low). However, today, we have already returned to $26 500 with a pump in the stock market.

Also check this:

Guys from Glassnode are saying:

Summary of the latest Arthur Hayes article by 0xjaypeg

Some thoughts from the team:

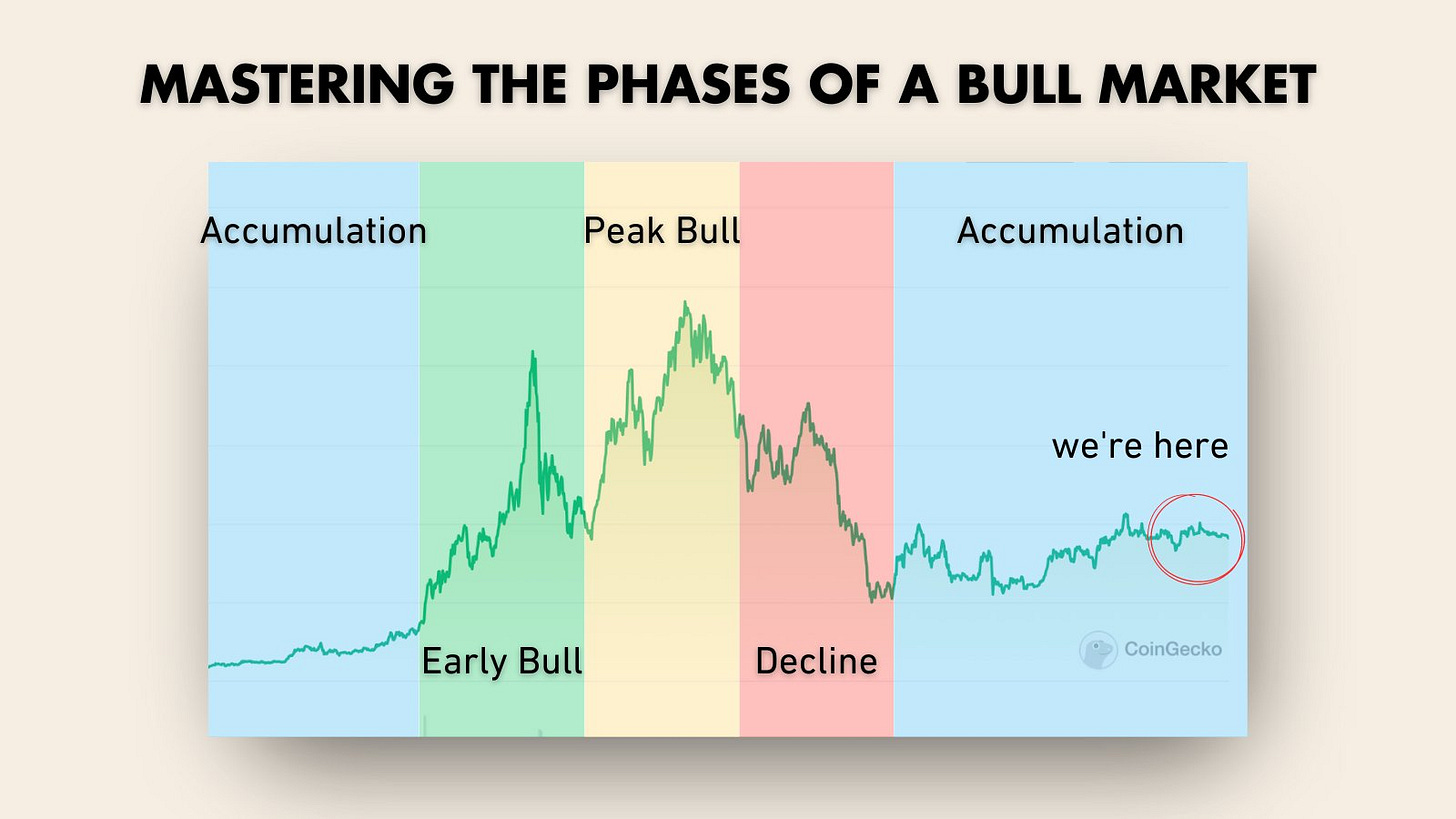

Right now, as we're so close to $20k, any dips are essentially buying opportunities if you're in it for the long haul. We've been DCA-ing (Dollar-Cost Averaging) Bitcoin, Ethereum, and a few other coins for a while now. Ultimately, it won't matter much whether you got Bitcoin at $20k, $25k, or $30k when it's valued at over $100k, right?The only thing we're not too fond of is that the market often enters a passive mode during such drops. Fewer projects get launched, there's a reduction in forming new narratives, and so forth. It's a direct correlation. This means making money right now is harder than during the initial euphoria, implying that we'll have to be more cautious, taking fewer risks and placing smaller bets on trades.

Also, I will try to sell my risky assets during this echo pump and stay with stables + fundamental coins (ETH, BTC, etc.)

🧠 Stay strong, stay solvent, and you'll be rocking the coming Bull Market. It’s really important to show up, level up your skills, and educate yourself while we have time for that.

Narratives for Rotatoooors

FriendTech

After extensive discussions with our Moni team and wider community, we've concluded that most social-fi protocols haven’t truly shone or achieved their potential. However, FriendTech stands out as a shining exception. The platform is actively attempting to provide added utility for its users, and various new protocols are sprouting around its foundation.

While there's an undeniable Ponzi-like structure to its operations, we believe the platform will continue its growth trajectory, primarily pulling users from the web2 realm. Interestingly, we're seeing non-crypto streamers diving into FriendTech, hoping to bag a few ETHs.

That said, sustainability is a concern. The current structure and mechanism longevity seems questionable.

Given Paradigm's investment in the platform and the point-based incentives, we anticipate an airdrop soon. Even if high-risk strategies aren't your style, getting your followers to sign up using your referral codes might be wise.

Alternatively, acquiring Twitter accounts for point generation could be a smart move. Remember, many Paradigm-backed projects, such as Uniswap and Blur – not to mention the NFT sensation, Art Gobblers – have initiated successful airdrops. They certainly know how to market and launch impactful airdrops.

For those interested, we've curated a list of pertinent discussions and thoughts surrounding this narrative:

ChainLinkGod about PWA

How shares(keys) pricing of friend.tech works by 0xCygaar

Deeper dive into friend.tech by Aylo

BASE: The Evolving Narrative

To be frank, some within our Moni circle, Miguelrare included, were anticipating a narrative shift, especially after the fallout from Bald's actions and the liquidity flow towards opBNB and Shibarium. Surprisingly, both chains faltered, making ventures there less lucrative compared to BASE. BASE isn’t just hosting the buzzing FrensTech; it's also home to industry stars like Compound, SushiSwap, Uniswap, and Balancer.

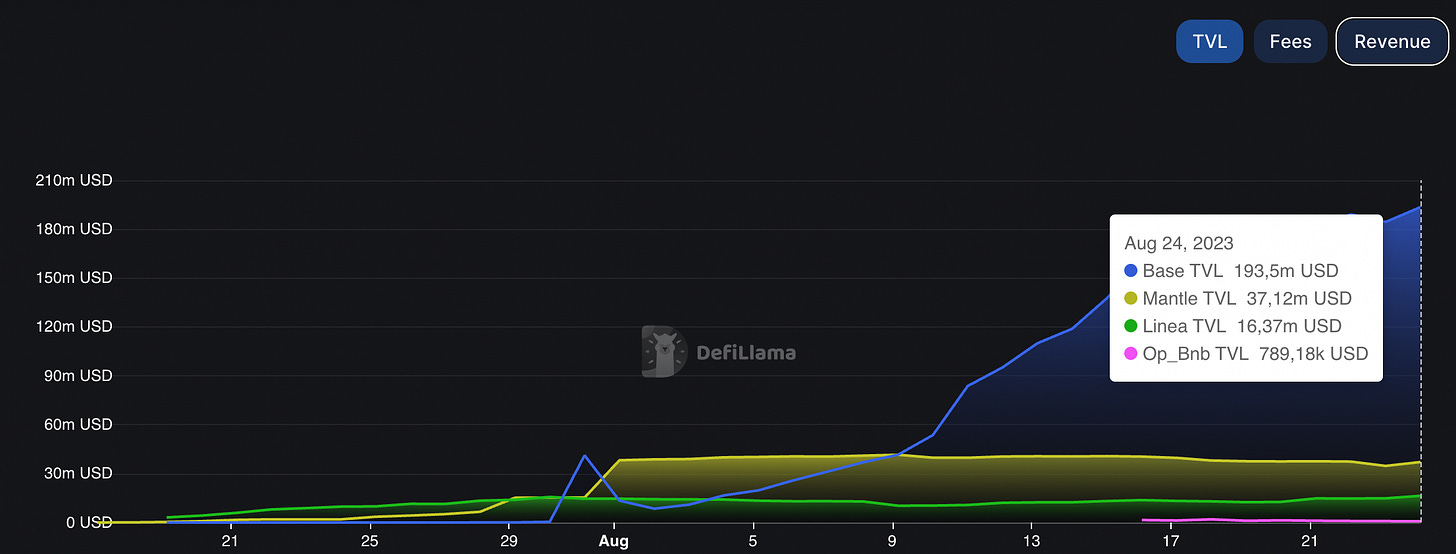

The Total Value Locked (TVL) in Base is on an uptrend, currently pegged at $190M. In contrast, some of the other anticipated chains are lagging:

Linea - $15M ;

Mantle - $37M;

And let’s not even delve into opBNB…

Solana’s Resurgence: DeFi 2.0

Solana's projects, at present, aren’t setting any new narrative standards. Yet, post the turbulence with FTX and Alameda, Solana hasn’t just survived; it’s displayed resilience, even as numerous projects shifted away or dissolved. [Insert graphic/chart]

There's a palpable energy and resurgence on the platform. We might be on the cusp of witnessing Solana’s renaissance. Recent listings have unveiled budding Solana-based projects that fit into trending narratives, like automation bots, social finance, and more. Stay tuned to our next chapter for a comprehensive insight into these ventures and Solana's current trajectory.

Solana thesis of 0xjay:

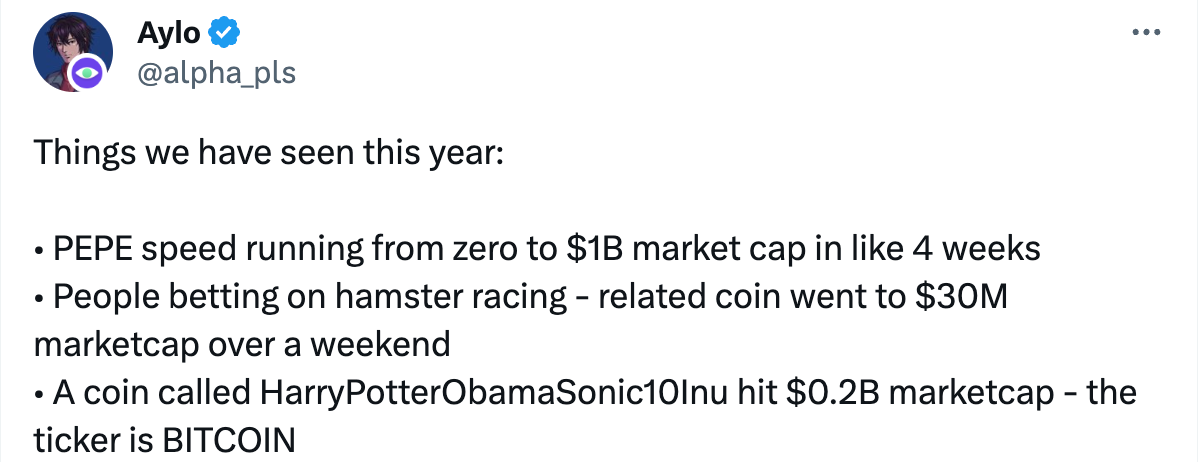

LINQ and REFLEX: OHM style ponzis

Both LINQ and REFLEX have garnered significant attention – new tokens with a (3,3) mindset and have cultivated a cult-like following around themselves.

Holders of these tokens are rewarded in LP (Liquidity Provider) tokens. Subsequently, they stake these LP tokens, locking them in for 7 days, and receive rewards in Ethereum.

Where do these rewards come from? From the buy/sell tax. How often are rewards distributed? Once every epoch (8 hours).

If you were a fan of Olympus DAO, you might want to take a closer look at this narrative.

Early projects (mostly Degen plays)

Arbitrum-based bot boasting features like sniping, futures trading, among others. Unfortunately, the token has already been launched, but we are still interested in it, given that the bot is incubated by GMD Protocol and could potentially fill the niche for bots on Arbitrum.

Chain: Arbitrum

Narrative: Bots

Twitter: https://twitter.com/GBOTofficial

The project appeared on the Moni Discover off-chain analytics app on August 4th. Since the project has already gained traction, beyond just the alpha hunters and "degens", it's being followed by influencers like Crypto Andrew.Restake Finance is built upon EigenLayer, which currently has $236M locked up. Overall, EigenLayer is one of the most talked-about protocols right now, and we believe projects built on top of it will be in demand. Restake Finance is poised to be the first among such projects, with their documentation, tokenomics, and beta version all set and ready. Given all these factors, the protocol will likely launch soon, and we are 100% certain that the success of Restake Finance will spawn numerous forks, given the huge unexploited niche it represents.

Chain: Ethereum

Narrative: -

Twitter: https://twitter.com/restakefi

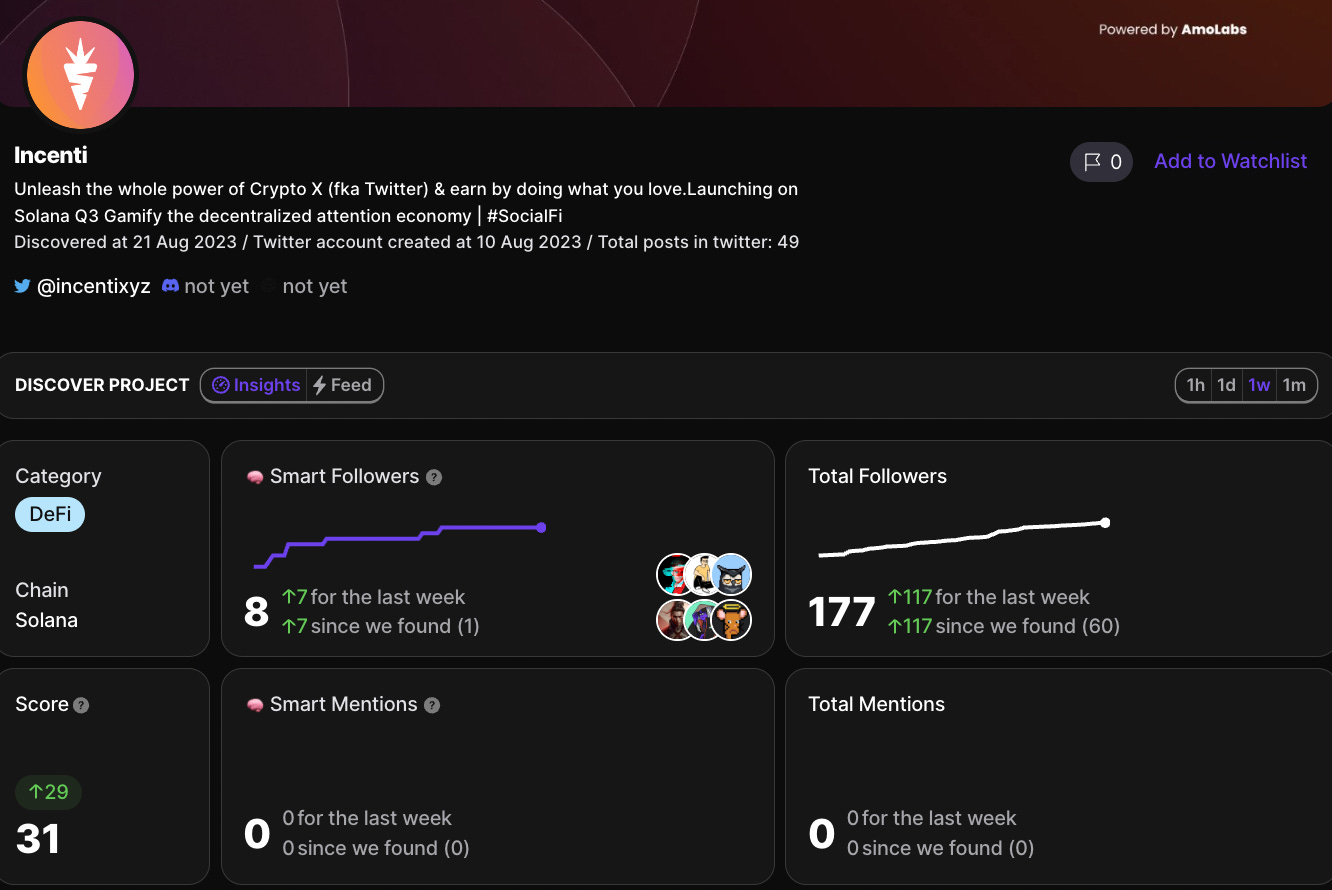

The project was introduced on the Moni Discover off-chain analytics app back on July 14th. It has garnered attention from many savvy crypto enthusiasts, including founders of various private DAOs beyond Moni, such as UDAO and AlfaDAO.Incentixyz: A new SocialFi protocol that aspires to create a web3 version of Twitter. Historically, such ideas haven't truly taken off. However, given FrensTech's popularity, we might witness a bit of a buzz around this.

Chain: Solana

Narrative: Solana, SocialFi

Twitter: https://twitter.com/incentixyz

The project was introduced to the Moni Discover off-chain analytics app back on August 21st, and since then, its followers and smart contracts have been growing organically. Notably, it's predominantly followed by Alpha Hunters and CJCJ, the latter also being a credible influencer in the space.

Friendlendtech: "Lend/Borrow for your shares(keys)?"

It's unclear how they intend to implement this, but such extensions over a popular protocol are bound to generate a lot of hype. Given the DeFi-lego structure being built on Friend.tech, this lending protocol could emerge as one of the biggest projects there.

Chain: Base

Narrative: Base, FriendTech

Twitter: https://twitter.com/friendlendtech

The project first appeared on the Moni Discover off-chain analytics app on August 22nd. While its subscriber count has been growing somewhat steadily, the number of smart contracts associated with it is skyrocketing. Apart from Alpha Hunters, it's being closely watched by notable figures like Small Cap Scientist, BurstingBagel, and many others.

FriendTechFarm: "Farming for your shares?" (keys). Essentially, all the information from the previous protocol also applies to this one, but instead of lend/borrow, here you will be able to farm shares (keys) on FriendTech.

Chain: Base

Narrative: Base, FriendTech

Twitter: https://twitter.com/FriendTechFarm

This project was found on the Moni Discover off-chain analytics app on August 22nd. In contrast to the previous protocol, it hasn't amassed as many smart contracts yet. This could be because the team hasn't published any posts so far, so the primary course of action here is to monitor and await further documentation or sneak peeks. Notable smart contract contributors include Rafi0x, a prominent figure known as "gigachad", and a member of our Moni Wizards community.

Dinari – Vampire attack of RWA DeFi to CeFi?

Dinari is less of a "degen" project and more of a serious platform for trading tokenized stocks, where each token represents a real share of the selected company. The protocol is already operational on the Arbitrum network.

However, a significant constraint might hinder its success – the need for KYC (Know Your Customer). To trade, users are required to undergo verification, which could deter a vast number of potential users.

On a side note, Dinari raised $7.50M in a seed round, backed by investors like Third Kind Venture Capital (3kvc) and 500 Global.Chain: Arbitrum

Narrative: RWA (Real World Assets)

Twitter: https://twitter.com/DinariGlobal

The project appeared on the Moni Discover off-chain analytics app on August 16th. So far, only a modest number of smart contracts and "degens" have shown interest. This makes sense since this demographic isn't their primary target audience.

Catalysts, News & Updates

Grayscale ETF Team is hiring

Circle launching USDC on Base, Cosmos, Near, Optimism, Polkadot & Polygon

Injective tokenomics upgrade, which can dramatically increase the amount of $INJ burned

Thorchain Lending went live. Now, you can lend and borrow native coins.

Aerodrome will go live on BASE next week

Farcaster migrating to Optimism Network

Aave V3 went live on BASE

Radiant Capital launching on Ethereum

DYDX v4 planned for October

PENDLE raise from Binance labs + new RWA arc dropped

Zeta V2

Other Dope Stuff you should check:

Current state of affairs of recent rollups that launched by Ash

List of current/future narratives by Vance Spencer

🫡 Thanks for reading, fren!

That’s it, end of the 1st issue. Please consider leaving feedback in the comments and vote in this poll.

Give us a follow on Twitter at @getmoni_io and join our Discord Community.

good read and very packed. pretty much covered all the happenings of the week. enjoyed reading

Love it! Alpha oooooozing out :)