Moni's Edge #6: Uptober incoming?

Alpha, Early Projects, Market overview, random thoughts, and just magic – wagmi.

gm, degens!

What's inside today?

Weekly dose of:

- Market update: Uptober is here, wagmi, Zhupercycle!

- Friend.tech vs Forks, Liquid Restaked Token (LRT) narratives explanation;

- 4 early alpha projects;

- Potential Catalysts and events;

- Useful threads, articles, tools and random thoughts;

💜 If you love what we’re cooking here and would like to support, click the button below:

State of the Market and News

So we were doing nothing first part of the week and the second part of the week we prepared for Uptober, I guess.

ETH pumped because of the rumors in the streets that ETH futures ETF gonna be launched soon (Valkyrie first, others later probably).

$BTC = $27k

$ETH = $1680

Nothing really interesting besides that, crab/chop market continues till we break $32-34k.

🔎 Other thoughts of OGs about the Market:

Nacho Trades agrees with Pentoshi on BTC rally in December

Trading Lord on ETH ETF approvals

Switch from a consolidation market to an uptrend market

With inscriptions now having several months of history to study, we find that they act as a sort of 'packing-filler' for blocks. There is minimal evidence that inscriptions are displacing monetary transfers, instead acting as a buyer of last resort for cheap blockspace.

Whilst this has improved the base-load demand for blockspace, and increased fee revenue meaningfully, the hashrate competing for it is also up over 50% since February. With extreme miner competition in play, and the halving event looming, it is likely that miners are on the edge of income stress, with their profitability to be tested unless BTC prices increase in the near term.

Glassnode

🤔 Also, here are some news

Asset manager @ValkyrieFunds got approval to add ETH futures contract

🧠 Just keep learning, showing up and keep rollin’ rollin’ rollin’

Narratives for Rotatoooors

FriendTech vs Forks

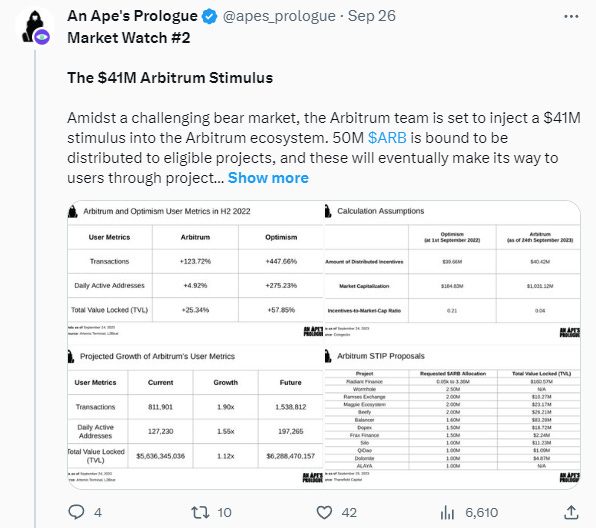

Frentech TVL continues to grow and reached a new peak of $48M on September 29, 3.3 is still popular and people are buying each other, it's not long before points are distributed, wonder how they will be distributed this time.

This narrative continues to live on, but our team is mostly eying the Frentech forks, which are also performing well. While last week was Post Tech, whose TVL went from $70k to $1M in a day, this week saw smaller forks like:

Words.art - A fork of Frentech, but instead of people you buy their words. When they launched, there was virtually nothing in the app. Now there are additional tools, soon there will be chat rooms and other things. TVL went up to 50 ETH in the beginning and during this week it dropped to 24 ETH, it is important to note that some influencers from ft liked this product, Herro even with such a small TVL continues to actively create words.

Cipher.Rip - FriendTech/PostTech fork on Arbitrum, after such a terrible failure of the SocialFi app, the project team decided to try to replicate the success of Post Tech, but they failed.Within two days TVL grew from $10k to $180k and then started to plummet, now it is only $46k. This is probably due to the fact that their app launched without any functionality. They had no messages working, no invitation codes, it was difficult to register due to many errors, people had problems buying/selling shares from time to time. During this time none of the problems were really solved, which is really strange. They were supported by Sudoswap developers (Zefram, 0xHamachi), they published a link to the platform on their Twitter, and the Cipher team claimed that they are partnering with arbitrum bd team, which is probably true, because bharat (partnerships OffchainLabs) is followed to them). Given all this, it is not clear why they did not prepare the basic functionality and why offchain labs did not see all these bugs.We continue to follow the project, but most likely it will not be able to resurrect after such a failure.

Liquid Restaked Token (LRT)

We decided to write about this narrative in advance, although we expect it closer to October-November.

The main idea of the projects under this narrative:

You stake your ETH in for example Lido and receive a small APY, you also get stETH. You can then deposit stETH into EigenLayer to earn even higher returns. Soon, we will be able to deposit stETH into EigenLayer through Restaking protocols and, in return, receive another ETH wrapper. Considering that EigenLayer's TVL is currently at $224M, protocols built on top of EigenLayer are likely to become very popular, because people will be able to unlock locked liquidity in EigenLayer due to the creation of additional wrappers.

Both new and old protocols are gradually starting to work on this area:

Restake Finance - this protocol was the first one we found in this narrative. Until about 2 months ago you could use the project in Testnet, and now we should expect mainnet, which should be released in Q4 2023.

By the way they recently raised $500k in Seed Round from DCDao, Moni Wizards, AlfaDAO and others.

*This is the project in the narrative that we are most bullishStader Labs is currently in the testing phase.

Astrid Finance is another protocol that is currently running on Testnet and appeared a month after Restake Finance, it is likely that there will still be a huge number of such projects and each of them will struggle for liquidity.

Liquid Restaked Token (LRT) - Get ready for the new ponzitokenomics era

Stader Labs tests 'Liquid Restaked Token' to amplify ether staking rewards

Early projects (mostly Degen plays)

Renzo Protocol

Nothing is known about the project yet, but their profile hat says Ethereum and EigenLayer. Given the impending ReFi narrative, after Restake Finance many similar projects started to appear, each of which we posted in our substack and apparently Renzo will be a new project on top of EigenLayer.Chain: Ethereum

Narrative: LRT

Twitter: https://twitter.com/restakefi

The project first appeared on the Moni Discover off-chain analytics app on August 26th.

Пока что за проектом следят исключительно дегены и альфа хантеры.

Fan Tech

Fan Tech is a new fork of FriendTech on Mantle, it was launched six days ago and so far has only reached TVL of 80k$, in our opinion the main problem is why they have not attracted much liquidity yet:1. Mantle has a small TVL and it's not a very popular chain

2. Post Tech may have scared a lot of people and that's why some users are not ready to move from frentech.

3. There is no shill from the big influencers as there was with Post Tech.

It is likely that each of these problems may soon disappear, as a huge number of Influencers have already joined the platform (Sisyphus, Levi, Herro, Digits Capital, etc.)

By the way, Mantle has one of the largest treasury in web3, they are trying to develop chain and this fork is like a gift for them.

Rumor has it that they may support the team, give them a grant and maybe even include them in the Mantle Journey (It's kind of like Arbitrum Odyssey), which will bring a huge amount of users to the platform and to this chain.

But what is the difference between Fan Tech and Friend Tech?

1. The 10 percent commission from buying/selling a share is distributed differently:

5% goes to the creator of the share

1% to the team

1% to the referral

1% to the liquidity of the share.

And it is the liquidity that is the most important chip that seems interesting, because thanks to it, the impact on the price when selling a share will be slightly less than if there was no liquidity at all.

2. When a new person registers on the platform and issues a share, a five-minute auction starts, during which the 10 highest bids will get the shares first.

This eliminates the problem of bots.

3. User friendly interface and reactions to messages!

While the project continues to be actively updated, it is also supported by one of Mantle's main Influencers, Defi Maestro.So, we continue to keep an eye on the project and hold shares of some Influencers.

Narrative: SocialFi

Chain: Mantle

Twitter: https://twitter.com/joinfantech

The project first appeared on the Moni Discover off-chain analytics app on September 1st.

In addition to degens, influencers such as Crypto Linn and Ignas is followed this project. Btw, they active there.

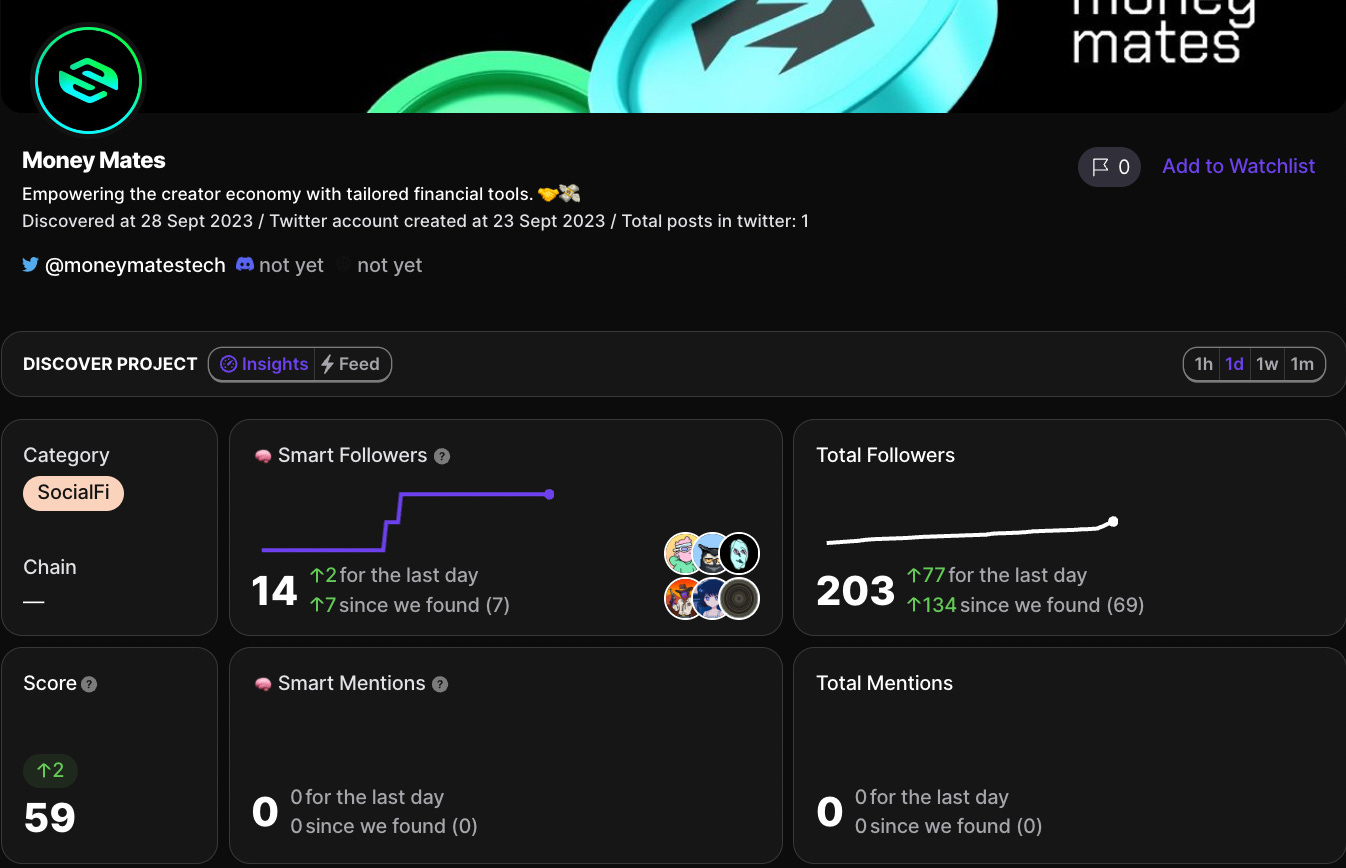

Money Mates

A new, not yet launched fork of Frentech.Its main thing is that the protocol will work on L0, perhaps with the help of this team will be able to attract an audience, as another ft on Arbitrum is unlikely to interest anyone.

Chain: Layerzero

Narrative: SocialFi

Twitter: https://twitter.com/moneymatestech

The project first appeared on the Moni Discover off-chain analytics app on September 28th.

Mainly degens and a few influencers followed for this project.

Unstable Protocol

This is a new project that aims to support the LSDfi minorities. It's gaining popularity very quickly. We're waiting for more details about the project.Chain: Ethereum

Narrative: LSDfi

Twitter: https://twitter.com/Unstable_money

The project first appeared on the Moni Discover off-chain analytics app on September 28th at 34 followers.

Catalysts, News & Updates

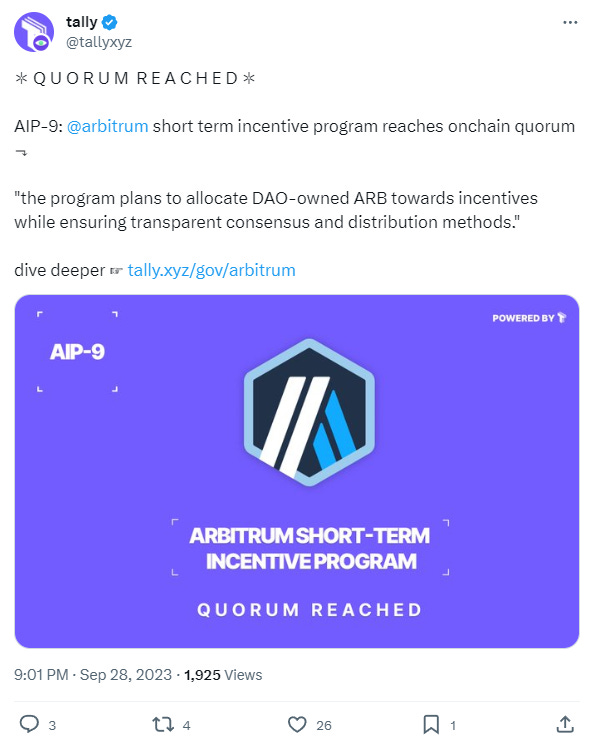

@arbitrum short termincentive program reaches onchain quorum

Crypto & Oil Synergy, Leading L2s and zk Implementations | 1000x

IBC is coming to the Binance Smart Chain

Other Dope Stuff you should check:

Summary of the last 1000x episode

🫡 Thanks for reading, fren!

That’s it, the end of the 6th issue. Please, leave a feedback in the comments and share the word.

Give us a follow on Twitter at @getmoni_io and join our Discord Community.